Bending the Curves to Drive ROI with Artificial Intelligence

There are a variety of ways to look at the return on investment (ROI) in artificial intelligence. The typical approach is to look at the investment in the context of improved top line results through, as an example, precision targeted marketing, or cost reductions through, say, process automation. Simple enough: if the benefit outweighs the cost, then you’ve received a return on your investment. Any investment in artificial intelligence should aim to deliver substantial ROI.But artificial intelligence can push the benefits far beyond simple ROI.

At KUNGFU.AI, we strive to deliver at least a 10x return on investment in all of the programs we deliver. That return can come in the form of increased revenue, higher profits or in the form of a potentially much bigger return: an increase in the enterprise value of the company.

Let’s dive into the potential impact of investments in artificial intelligence on the valuation of a company as part of a broader ROI analysis. Raising the equity value of a private company can lead to more successful fundraising or a higher exit valuation. For public companies, raising the value of the company translates to raising the stock price.

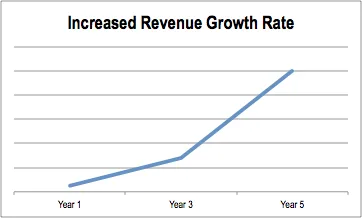

When valuing companies, there are several factors that can make a substantial, if not dramatic difference, in the overall enterprise value of a company. One such factor is a company’s growth rate. Companies with higher growth rates, all things being equal, tend to get rewarded with higher multiples and, therefore, higher valuations. This is called “bending the growth curve” and is illustrated in the graph below. Investing, as an example, in an artificial intelligence solution to improve the efficiency of targeted marketing that increases the top line growth rate should lead to a higher valuation multiple and therefore an increase in equity value.

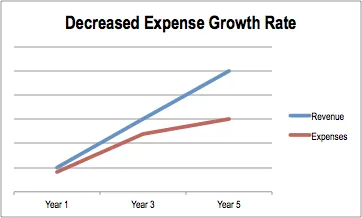

Likewise, companies that decrease their expense growth rate and thus increase their profitability also, all things being equal, should earn higher multiples and a higher valuation. This is called 'bending the cost curve’ and is illustrated in the graph below. Rather than expenses going up up at a rate that is equal with revenue, improving that relationship is noteworthy to investors.

Investing in artificial intelligence solutions aimed at driving both top line growth and increased profitability can deliver even greater benefits. Companies that can increase their revenue revenue growth rates while at the same time increasing profitability are typically very handsomely rewarded from a valuation point of view as it is a difficult thing to achieve. In fact, there is an unspoken assumption that revenue growth and increased profitability are incompatible over the long term, despite the fact that there are numerous examples of companies that are effective at delivering both. This is called 'bending the growth-margin curves’ and is illustrated in the graph below. Revenue is increasing at a faster rate at the same time costs are growing at a slower rate.

Working to positively change the relationship between revenue growth and cost growth is achievable with artificial intelligence. And yet there’s an even greater benefit to aiming for such goals. There is the opportunity to move your company, from a valuation point of view, into a new valuation category. Companies with lower growth rates, lower profitability and that leverage technology less tend to get valued with relatively low valuation multiples. Conversely, companies with increasing revenue growth rates and increasing margins and that have sophisticated uses of technology tend to get rewarded with the highest valuation multiples. Moving your company to a higher valuation category can deliver incredibly high ROI on investments. And these are the types of impact that can be achieved through investments in AI.

The example below, which is simplified to make the point, compares two companies in the real estate industry. Realogy, which operates under brands such as Centurey 21 and Coldwell Banker, is a relatively slow growing company and is valued at a low multiple of revenue. Zillow, on the other hand, is a high growth technology-enabled company with a much higher multiple of revenue. If companies with characteristics like Realogy can transform themselves into companies more like Zillow by leveraging technology, they can see dramatic increases in value from this multiple expansion.

Continuing with this example, investments in artificial intelligence that increase a company's revenue growth rate and profitability has the potential to move them from being valued at 1x revenue to 8x revenue. Let’s assume the company has the opportunity to grow to a $100M business over the next several years and can do so at a growth rate that is faster than their historical growth rate, with higher margins and leveraging advanced technology, including artificial intelligence, throughout the company. Such a company has the potential to go from being valued at 1X revenue to 8x revenue, or $100M to $800M, which is an increase in value of $700M.

As this example shows, investments in technology like artificial intelligence can have a major ROI through their impact on equity value.

Can artificial intelligence make such dramatic changes in a company’s operations to expand its multiples so dramatically? The answer is yes, but it takes a disciplined approach. At KUNGFU.AI, we’ve developed a client engagement process that begins with a discovery and strategy phase that produces both solutions to current business problems and a roadmap for transformational change at the technology and organizational level. These recommendations and roadmap are developed with the goal of improving a company’s growth and cost curves enough to improve its enterprise valuation metrics. It won’t work for every company and it doesn’t happen overnight, but it is absolutely possible.

The trifecta of an investment in artificial intelligence technology solutions - bending the growth curve, bending the cost curve and moving to a higher valuation category - should have a dramatic impact on a company’s valuation. Multiples go up at the same time that the top line and bottom line numbers they’re being applied to are going up as well.

When looking at artificial intelligence projects through the lens of valuation increases, it is easy to see how investing in AI-based solutions can deliver dramatic returns on investment.